COLUMN - This document sets out a blueprint for 1) what percentage of a portfolio can be drawn as an annual income; and 2) what the portfolio needs to look like to maximise the probability of success.

Success is defined as the ability to draw an income that increases with inflation for a period of 30 years or longer.

The largest determinant of success is the starting drawdown rate

The largest determinant in the success rate of a portfolio is the starting drawdown rate. This is defined as the % of the portfolio you intend to draw down as an income each year.

If your total portfolio was valued at R10 million and you required a R500 000 per annum income, the drawdown rate would be calculated as 5% (500 000/10 000 000).

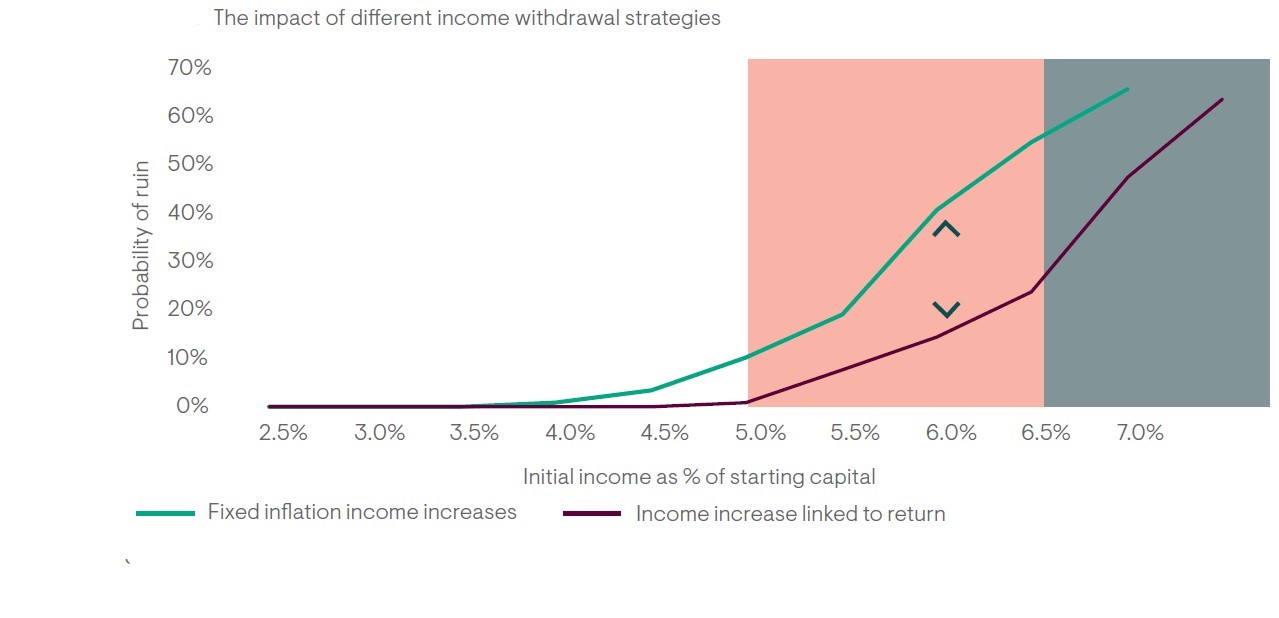

The table below sets out the probability of ruin for different starting levels of income drawdown. The vertical access is the Probability of ruin and the horizontal axis is the Initial income as a % of starting capital.

Source: Ninety One SA (Pty)Ltd

Source: Ninety One SA (Pty)Ltd

The two lines represent two different withdrawal strategies: the green line shows the probability of ruin when the income is adjusted by a fixed % each year, and the red line shows the probability of ruin when each year's adjustment is linked to the market return.

Conclusion of this data is twofold:

- Picking a safe income level at the outset is critical

- We can significantly reduce the probability of ruin if we link our annual increase to market returns

Exposure to growth assets and having the correct offshore exposure is critical

The starting level of income is critical, and the lower the drawdown rates the lower the probability of failure. However, as the level of starting drawdown increases, so does the need to make use of growth assets (equities/shares).

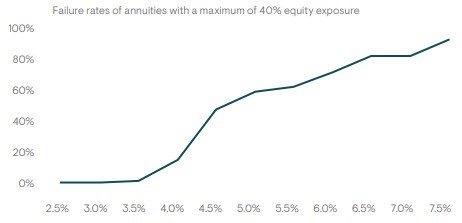

The chart below illustrates this. It shows that a portfolio with 40% exposure to growth assets with a 3.5% drawdown starting income has almost 0% chance of ruin. However, as you move to a 5% starting income drawdown, the probability of failure drastically increases to close to 60%.

Source: Ninety One SA (Pty)Ltd

Source: Ninety One SA (Pty)Ltd

Most drawdown rates we see are in the region of 5% to 10%, and therefore these portfolios must have meaningful exposure to growth assets if they are to succeed. Growth assets are equity investments - investments in companies listed on a stock exchange.

To add another layer of complexity to the problem we are trying to solve is the currency. The ZAR goes through long periods of weakness and strength. Many individuals have been burnt with predictions of the ZAR and taking funds offshore when the currency is weak.

The table below shows that the ZAR goes through extended periods of strength and weakness.

The lesson is that we must be careful of the level of offshore exposure in the portfolios. Too much offshore exposure can be a bad thing if the ZAR went through an extended period of strength. Thus, identifying the optimal % of the portfolio to be exposed to offshore assets is critical.

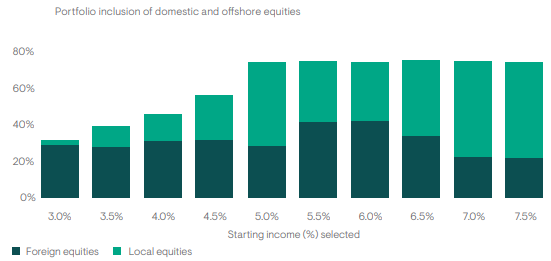

The table below sets out the optimal exposure to growth assets as well as the ideal local and offshore exposures for different starting levels of income.

Source: Ninety One SA (Pty)Ltd

Source: Ninety One SA (Pty)Ltd

Starting drawdown rates of 5% require total exposure to growth assets in the region of 70%. This should be made up of 40% local growth assets and 30% offshore growth assets.

To summarize

- The starting drawdown rate is critical in determining the probability of success.

- We don’t want to go much beyond a 5% starting drawdown rate.

- At these levels, we need approximately 30% of the portfolio exposed to offshore growth assets and 40% exposed to local growth assets.

- The balance should be invested in a combination of cash and bonds.

- We can meaningfully increase the probability of success of a portfolio by linking the annual adjustment of our income to the market returns of the portfolio

Matthew Matthee

Matthew Matthee

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’