BUSINESS NEWS - There's a business coach I follow on LinkedIn. He isn't your typical LinkedIn personality. His posts are insightful and backed by practical experience.

He calls himself the 'CEO whisperer.' Essentially, businesses hire him as their 'shareholder' to whom they report and bounce ideas off. He provides this service to 35 to 50 businesses with turnovers ranging from R10 million to R100 million.

He's achieving great success. It helps that he gains insight into each of these businesses, acts as a central resource to pass on what’s working and what’s not, and provides top-quality practical advice to each owner.

He’s been in the business of coaching on close to a decade, having successfully built and sold a business himself. He's witnessed the journey businesses go through – years of toil with little to no reward.

He writes –

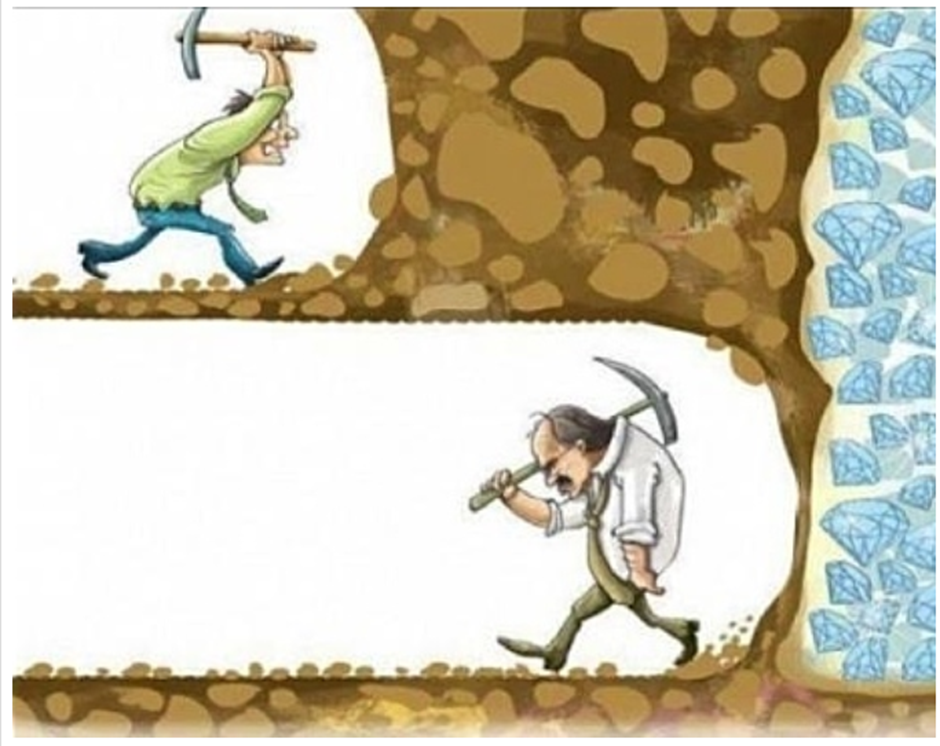

Imagine grinding away at a goal. Feels like you're staring at a blank wall for ages, right? But hold tight, because out of the blue, bam! Big progress smacks you in the face.

Here's the hitch: most people throw in the towel before they've even given it a proper shot. The real deal? It's about sticking to your daily routines, using solid strategies, and learning from both your gut and what others say.

All that extra stuff? Just noise. The real progress comes when you've got your head in the game and the patience to keep at it day after day. Slowly but surely, those small steps lead to something seriously game-changing.

It reminds me of the following cartoon

It made me think about investing and the last few years on the JSE

From 2015 to about 2020, the JSE went nowhere. The market gains averaged about 4% per year over five years. During the same period, you could get 8% for cash in a bank. Those were tough years and challenging client engagements. Why put your money in the volatile JSE when you could put your cash in a bank and guarantee 8%?

But then, in late 2020, the JSE shot up 40% in a matter of months (boom!).

Have a look at the chart below -

Chart: JSE All Share Index

Chart: JSE All Share Index

The point is that sometimes we just need to be patient. Grind it out when the market moves sideways. But most importantly, make sure we are prepared when the markets run, as they inevitably will (and have done so for the past 100 years).

Long-term, the market goes up. It beats cash and bonds.

Make sure you are prepared when that happens. A 10% return in cash and bonds is nice for now, but don’t let that distract you from the power of the market.

The real gains happen when you least expect it, and it is precisely those short bursts of 40% to 50% that can change your life. And you need to be ready when that happens.

Matthew Matthee

Matthew Matthee

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’