BUSINESS NEWS - Across the world, stock markets are seeing an extreme and unusual divergence. There are certain regions and sectors that are highly in favour and therefore richly priced, while others are severely out of favour and looking extremely cheap.

“For instance, the difference in valuations between the S&P 500 and emerging markets is the highest on record,” says Greg Hopkins, chief investment officer at PSG Asset Management. “The difference between the most expensive and least expensive parts of the US market is the highest it’s been since the 1950s.

“And if you look at South Africa, there is a subset of South African shares where valuations are lower than they were in 2008 and 2009 (after the global financial crisis) and 2002 (after the dot-com crash).”

Predominantly, these stocks can be found in the mid- and small-cap sectors on the JSE. Traditionally, mid and small caps have outperformed the Top 40, but as the chart below shows, this has not been the case in recent years.

Source: FTSE Russell

The underperformance of small caps has been particularly dramatic, with this part of the market showing a negative return over every period up to three years. Mid-cap underperformance is less pronounced over the full five-year period, but since 2016 it has been substantial.

Extreme valuations

“What’s happened over the last three years is that mid caps have considerably underperformed large caps,” says Eugene Visagie, portfolio specialist at Morningstar Investment Management. “And that gap has widened quite considerably.”

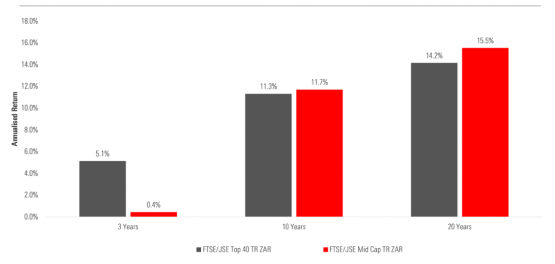

As the graph below shows, this is meaningfully out of line with the longer-term picture. Over 10 and 20 years, mid caps have outperformed. This recent weakness is a distinct anomaly.

Source: Morningstar

A major reason for this is that sentiment towards this part of the market has grown extremely negative, as many mid-cap companies are highly exposed to the South African economy. Given the weak local environment, investors are extremely cautious about the prospects of these businesses.

However, there are some excellent and highly resilient companies in this universe that have been sold down heavily and are offering increasingly attractive valuations. They include the likes of fast-moving consumer goods group AVI, retailer Italtile, and financial services businesses RMI Holdings and Santam.

| Mid-cap valuations | |||

| Counter | P/E ratio | Forward P/E | Dividend yield |

| AVI | 16.29 | 14.41 | 4.93% |

| Italtile | 13.27 | 10.4 | 3.03% |

| RMI Holdings | 12.36 | 9.05 | 3.57% |

| Santam | 13.89 | 14.2 | 3.67% |

Source: Profile Data

There are also other mid-cap companies that have experienced difficulties, and are now trading at more extreme levels. These include leisure group Tsogo Sun, forestry and paper company Sappi, asset manager Coronation, and chemicals group AECI.

| Mid-cap valuations | |||

| Counter | P/E ratio | Forward P/E | Dividend yield |

| Tsogo Sun | 8.12 | – | 14.75% |

| Sappi | 4.62 | 6.44 | 6.12% |

| Coronation Fund Managers | 11.19 | 10.41 | 8.92% |

| AECI | 10.06 | 8.11 | 5.45% |

Source: Profile Data

A number of investors are now finding this combined opportunity set extremely exciting.

“Mid caps in South Africa are probably one of the most stand-out opportunities from a global perspective,” Hopkins argues.

Playing out

Even though the local environment is weak, some analysts argue that the valuations are so undemanding that the prospects for future returns off these levels are attractive. As Loftie Botha, portfolio manager at Momentum Investments, points out, if you take a view of the market as a whole the numbers are compelling.

“The median forward price-to-earnings (P/E) of all the stocks on the JSE with consensus forecasts is 10,” he notes. “However, the median of their historical P/Es is 14. That means a 40% upside.”

One might argue that analyst earnings forecasts are too optimistic, and the forward P/Es are therefore too generous. Yet even if one halves those assumptions, the upside is still 20%, excluding what investors might see from dividends. Currently, the median yield is around 4%.

“One shouldn’t bet the farm, but you don’t want to miss out when these things turn,” Botha says. “The market has been very disappointing for a very long time and even if sentiment only partially improves we could have a very attractive market and then mid and small caps should outperform.”

While some investors might argue that they would want to see an improvement in South Africa’s economic fundamentals before entering this part of the market, Hopkins believes one shouldn’t try to anticipate what might unlock this value.

“One of the dangers is to try to time this and look for catalysts,” he says.

“These catalysts come from different areas, and it’s difficult to stipulate where that will be and to wait for them,” Hopkins adds. “If there is apparent value and companies are not going backwards, we think that the best catalyst is time. Over long periods of time, when you have these anomalies, generally they play out.”