BUSINESS NEWS - If you received an R1 million bill with your restaurant dinner, your jaw would likely hit the floor. But what if you knew that your weekly takeout meals could be worth an extra million rand in your retirement pot?

This is because of the potent combination of compound interest and time, which can transform even small amounts into significant wealth.

Compound interest is the process whereby your savings, and the interest earned on your savings, earn additional interest to become a powerful multiplying machine.

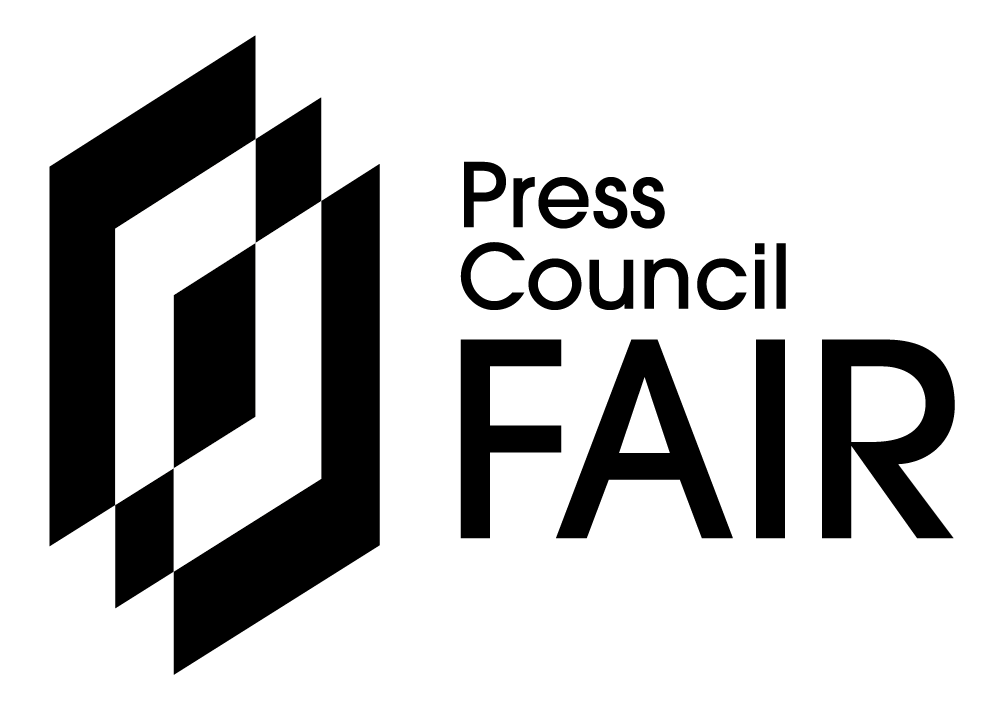

As a simple example of just how powerful compound interest can be, imagine that someone offered you the choice between winning R30,000 today or a magical cent that doubled in value every day for 30 days. At face value, the first option seems far more appealing. However, if you instead chose the magical cent that doubles every day, your winnings would gradually pick up momentum as the month went by, growing from just a few rands at the end of the first week to over R5.3 million by the end of the 30 days.

Of course, there is no such thing as a magical doubling cent, and in reality, the process of earning compound interest on savings and investments works much more slowly, growing savings steadily over years and decades rather than all within the space of a month. But what the example shows is the power of what investors know as the principle of “compounding”.

Table: The magical doubling cent

How small savings on a takeout meal can transform into R1 million

Returning to our original example, consider if, at the age of 25 years old, you take a hard look at your budget, and make the decision that instead of spending R125.00 on takeout meals each week, or R500 a month, you will opt for home-cooked meals instead.

Crucially, you then make the conscious decision to invest these monthly savings instead. If you invested this money into an equity portfolio for the next 40 years, you would end up having saved a total of R240,000 towards your nest egg.

But, if this portfolio then achieved average annual returns of 12% and inflation remained at 6%, by the time you retire at the age of 65 years, your investment would be worth a whopping R996,000 in real terms.

In other words, your weekly takeout alone could mean almost R1 million extra in your savings pot through the same potent combination of compound interest and time.